Over 150 weeks of animated data answers my question: can money buy happiness?

I have analyzed over 150 weeks of compiled personal data to answer one of the most frequently asked questions of all time: can money buy happiness?

The answer is yes, money can definitely buy happiness, but certainly not unconditionally. We should all try to spend money mostly on things that will have a positive result on our happiness. After tracking and analyzing my data, I have found that certain expense categories are more directly correlated to my happiness than others. It’s clear that I tend to be happier when I spend more money on these expense categories.

Table of content

Contents

A brief introduction

A lot of research has been done on the effects of money on happiness. Some claim that money could never buy happiness. Other studies state that money does buy happiness, but only up to a certain level. What none of these studies have done, however, is to use quantitative analysis to answer this critical question.

I want to shed light on this question, by combining my personal financing data with my happiness tracking data. I will try to find the exact answer to this challenging question by looking purely at my data.

Can money buy happiness?

In addition to my personal happiness, I have also been tracking my personal finances! What does that mean? Well, I have kept track of every single penny that I have earned or spent. I started doing this when I landed my first job as an engineer, back in 2014. I was already tracking my happiness at the time. Therefore, I am now able to combine these two personal databases, to show you how my finances have influenced my happiness for the past 3 years!

But first, let me briefly walk you through a little background.

What’s my financial situation?

I started my career after the summer of 2014 as a 21-year old guy. As I’m typing the results of this analysis, I’m 24 summers young. Therefore, my financial situation can be quite different than yours.

For example, I have lived in multiple places during this entire time, but I mainly stayed at home with my parents. I have never consistently paid for a mortgage or rent for longer than a few months, so housing costs are not included in this analysis. Therefore, the results of this analysis might not necessarily be applicable to you.

As I grow older, my personal observations and happiness factors might also shift. Only time will tell. It might be interesting to revise this analysis after another couple of years.

Financially independent?

I am very conscious about spending my money. Some of my friends call me frugal. I wouldn’t necessarily disagree with them since I am actually striving to become financially independent.

A person is considered financially independent when a passive income can cover the entirety of your expenses. This passive income might be produced by investment returns, real estate, or a side business. The concept of financial independence is explained in much more detail by Adam over at Minafi. As far as I know, he has written the most in-depth guide on the principles of financial independence. I believe a great introduction like this can change your life.

A lot of people who become financially independent quit their jobs and enjoy a lifestyle free of stress. This financial mindset is not strictly about retiring early or spending the smallest amount of money though. No, for me it’s about discovering and achieving life goals: “What would I do with my life if I didn’t have to work for money?”

This mindset helps me focus on getting the most value out of my money. I don’t mind spending a lot of money, as long as I spend it on something I know will bring me value. One of the biggest principles that I’ve adopted is to not spend money on things that don’t make me happy.

If I truly live according to this principle, then money should really buy me happiness. I try to spend money only on things that make me happy. So, therefore, my happiness should increase when I’m spending my money. Right?

Let’s dive straight into the data!

My financial timeline

I have been tracking my personal finances since the day I started earning an honest salary. By accurately tracking expenses, I’m able to determine exactly how much I’m spending over a given period. This is a great way to maintain healthy financial habits.

Below you can see a timeline of all my expenses, from the day I started tracking my finances. This graph includes all my expenses, ranging from petrol in my car to the beer I drank on a holiday. This includes everything. It even includes the money I’ve spent on prostitutes and cocaine. I’ve added some context here and there to detail some of the spikes, just to give you an idea. This is a wide graph, so feel free to scroll from left to right!

You can learn quite a bit from this chart already. You can see how my expenses are distributed, and how much money I roughly spend per year. As a 24-year old dude, I believe my expenses can look very different from yours.

Most of the spikes in the chart are single big expenses, like lump sum payments, holiday tickets, tech products, and car maintenance bills. It’s impossible for me to detail every expense in this graph since it features over 2,000 transactions, but I’ve done my best to provide some extra context.

I like the fact that there are a lot of “Zero Spending” days in there! These are the days where I spent absolutely nothing. There are even some “Zero Spending” streaks hidden in there. I’ve spent some periods working on projects abroad. During these periods, I simply did not have enough time left to spend my money after working over >12 hours a day, seven days a week. 😉

Lifestyle inflation?

Finally, I’ve added a linear trend line to my cumulative expenses. This shows me that my expenses have grown a little during this entire time. I don’t want to fall victim to lifestyle inflation! “What is lifestyle inflation?”, I hear you ask. It’s the phenomenon of increasing expenses when your income goes up, according to Investopedia.

Is this necessarily a bad thing? Well, if I ever want to become financially independent, I should try my hardest to protect myself from lifestyle inflation.

But what if money can actually buy me happiness? Would lifestyle inflation really be a bad thing? After all, happiness is the prime goal in our lives. Well, if all this extra money that I’m spending is actually improving my happiness, then I shouldn’t really care, right? Lifestyle inflation? Hell, yeah! Where can I sign up?

The question remains: can money buy happiness? This graph is obviously not going to answer that question. I need more data for that!

Combining finances with happiness!

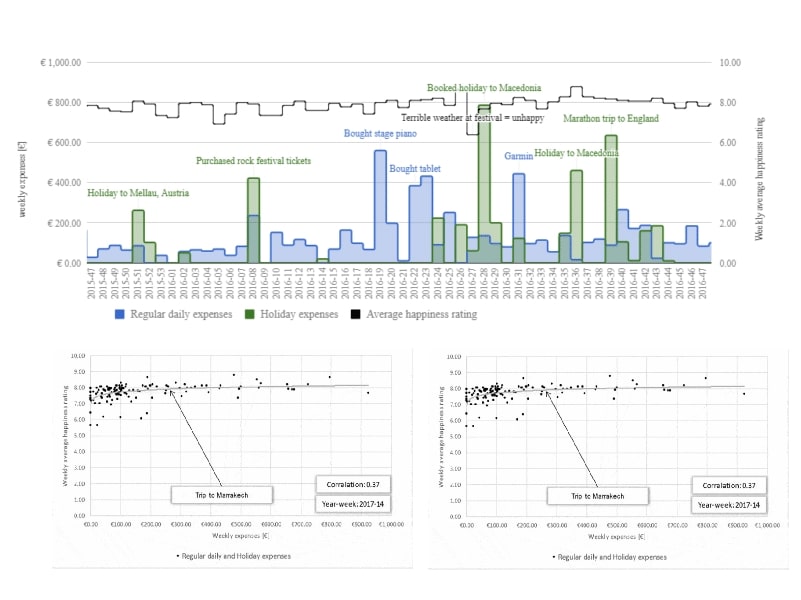

You would not be reading this article if I hadn’t been tracking my happiness during this entire time frame. I want to show you this set of data as well! I’ve created another graph that summarises my happiness tracking and personal financing data per week.

This graph shows the weekly sum of all my expenses in red and my average weekly happiness rating in black. As you can see, there are quite some different periods here. Again, I’ve tried to add some context here and there, to give you an idea of what my life looks like.

I’m happy to see a few weeks in which I didn’t spend anything. Zero spending weeks! These weeks always coincided with periods of working abroad on projects. The projects were always quite demanding, and I would have neither the time nor energy at the end of the day to spend my money. Great, right? 🙂

Now, these projects always affected my happiness, and most of the time negatively. Working >80 hours a week usually broke me up after a while, especially when I was working as an expat in Kuwait. So with this example, these weeks would strengthen the theory of whether or not money can buy happiness. I wasn’t spending a lot of money, and my happiness was also below average.

Now this example might not be the best one, as I cannot guarantee that my happiness would have been higher had I spent more of my money. There were so many other factors influencing my happiness, it’s impossible to tell if higher, bigger or more expenses would have resulted in more happiness.

But this is just one week. I have tracked over 150 weeks of data, and they are all included in this analysis. It’s impossible to answer the main question of this analysis – can money buy happiness? – by looking at just one week. However, I believe the big number of transactions and weeks will provide me with reliable results. It’s the law of large numbers in action.

💡 By the way: If you want to start feeling better and more productive, I’ve condensed the information of 100’s of our articles into a 10-step mental health cheat sheet here. 👇

This Cheat Sheet Will Help You Be Happier and More Productive

Thrive under stress and crush your goals with these 10 unique tips for your mental health.

Anyway, as you are probably aware, I have just plotted two dimensions in a single chart: my happiness and my expenses. This is exactly what I need in order to answer that one question: can money buy happiness?

Well, can you answer it already? I guess not! A scatter chart is obviously much more suitable for the presentation of these two sets of data.

This graph shows every single week of my data as a point, plotted on two dimensions.

If money would unconditionally buy me happiness, then you would expect to see a very positive correlation. Well then… Where is it? ¯_(ツ)_/¯

Distorted data

Even though the linear trend line is slightly increasing, I think this is truly insignificant. For the data analysts among us, the Pearson Correlation Coefficient is only 0.16. This graph obviously doesn’t answer my question. It does not confirm whether or not money can buy me happiness. I am afraid the data is too distorted with noise. And with noise, I mean expenses that should not be taken into account in this analysis.

For example, I don’t think my health insurance should be included in this kind of analysis. Sure, good health insurance is vital for happiness in some scenarios, but not for mine. I’ve spent €110.- on my health insurance once every 4 weeks, and I can certainly tell you that it did not once influence my happiness. Neither directly or indirectly.

There are many other expenses like these, and I feel like they cloud my analysis. There are also some expenses that might have influenced my happiness indirectly, instead of directly. Let’s take my monthly phone bill as an example. If I hadn’t spent any money there, I would not have enjoyed the luxury and comfort of an online smartphone. Would this directly have influenced my happiness? I highly doubt it, but I think it would have influenced it indirectly in the long run.

I would not have been able to call my girlfriend after a long day at work, or I would not have been able to avoid a traffic jam based on live maps. You might think these are silly examples, but there is actually an endless list of reasons how a single expense could have influenced my happiness.

That’s why I purely want to focus on the expenses that had the potential to directly influence my happiness.

Expenses with a direct influence on my happiness

First things first: I don’t spend my money on prostitutes and cocaine, as I joked before. That’s not my kind of jazz.

I do have many other expenses that I believe directly contribute to my happiness. For one, I believe the money I spend on holidays makes me happy. I also believe that a nice dinner with my girlfriend makes me happy. If I buy a cool new game for my PlayStation then that game is probably going to have a positive effect on my happiness.

Anyway, if I could only divide my total expenses into smaller subcategories, then I would be able to test the effect of these expenses on my immediate happiness.

Insert categorized expenses

Well, luckily I have done just that! I have categorized all my expenses from the day I started tracking my finances. I have grouped these in many different categories, like housing, road taxes, clothing, charity, car maintenance, and fuel. However, there are two categories that I believe directly influence my happiness. These categories are Regular daily expenses and Holiday expenses. Regular daily expenses can range from having a beer with my friends to buying lunch at the office and from a ticket for a concert to a new PlayStation game. Holiday expenses are including anything that regards one of my holidays. Think about flight tickets, excursions, and rental cars, but also drinks and food.

I have created the same chart as before, but now included only the Regular daily expenses and Holiday expenses.

I have tried to include some additional context in this graph again. You can see the period in Kuwait that we discussed earlier. I didn’t spend a lot of money during this period, and my happiness was way below average. Coincidence, or not? You tell me, since I don’t know yet. 😉

Regular daily expenses

If you look at my Regular daily expenses, there are a couple of interesting spikes. For example, when my girlfriend went to Australia for half a year, I soon after bought myself a PlayStation 4. A long-distance relationship sucks enough as it is, but being bored at the same time doesn’t really help. So I decided to splurge on the newest gaming console, and sure enough: it positively influenced my happiness! Gaming became a great happiness factor for me when my girlfriend wasn’t around.

There are a lot of other big expenses like these. My happiness was generally higher at the times when I bought a stage piano, a Garmin running watch and a tablet. It may sound silly, but these expenses seem to have directly increased my happiness. Great, right?

Holiday expenses

Now, have a look at my Holiday expenses. The effect of these expenses seems to be even bigger. My happiness has been incredibly high whenever I was on holiday. My holiday in Croatia is a pretty great example of this.

It sounds quite logical, right? Most people are usually happier on holidays, as it’s something we all look forward to. That raises the next question: is more happiness the result of spending money on holiday, or just the result of being on holiday? I tend to think it’s a result of being on holiday.

But in the meantime, it’s pretty hard to go on holiday without spending any money, right? Spending money on holidays allows us to actually go on holidays. Therefore, you need to spend money in order to experience more happiness while being on holidays. If you want to get textual, then these expenses – just like the others we discussed – do not have a direct effect on happiness. But I think these expenses have the most direct effect on my happiness.

Additionally, another issue with my data is that the expenses prior to my holidays are also included in my Holiday expenses. There are occasions in which I spent a lot of money on holidays without actually being on holiday. You can tell by the comments in the chart that this was mostly because I booked tickets or accommodation prior to the holiday. Did these expenses directly influence my happiness? Probably not, but I’ve decided to still include them in this analysis. I don’t want to mess with the original data set to skew the results.

Correlating my happiness

So how do these two categories correlate to my happiness, exactly? Let’s have a look at the effect of my Regular daily expenses on my happiness.

Again, there is a slightly positive linear trend visible in this set of data. On average, my happiness seems to increase slightly as I spend more money on Daily regular expenses. Even though it’s higher than before, the Pearson Correlation Coefficient is still only 0.19 though.

I believe the results from this set of data are more interesting though. You can clearly see that the most unhappy weeks in this data set occurred when I spent below average on the Daily regular expenses. The amount of money I spend per week seems to mostly influence the lower bound of my weekly average happiness ratings. Of the weeks in which I spent more than €200,-, the lowest weekly average happiness rating was 7,36. Even though the correlation is not that significant, I do tend to be happier when my expenses get higher.

How about my Holiday expenses?

As expected, the effect of my Holiday expenses on my happiness is bigger. The Correlation Coefficient is 0.31, which could almost be called significant. A correlation of this size is quite impressive, actually, since my happiness is influenced by a lot of other factors as well. These other factors are obviously distorting the results of this analysis.

For example, I spent a weekend at a rock festival in Belgium, during which the weather was absolutely horrible. This weather had a huge negative effect on my happiness. I still spent some money on this “holiday”, but the influence of these expenses on my happiness was clouded (pun intended) by the terrible weather.

That’s why I think a correlation of 0.31 is very impressive. I have also analyzed the influence of arguably my biggest happiness factor: my relationship. This analysis showed me that the correlation between my relationship and my happiness is 0.46. That’s as high as it gets, in my opinion.

Can money buy happiness?

What these scatter charts reveal to me is that money does indeed buy me happiness. The true effect is hard to determine, as the influence of money on my happiness is almost always indirect. However, I do tend to be happier as I spend more of my money.

To wrap this analysis up, I have combined my Daily regular expenses and Holiday expenses to create the chart below. This chart is a combination of the two previous scatter charts, where each point is now the sum of both these categories. This is also the same chart that I animated in the abstract of this article.

The Correlation Coefficient within this combined set of data is 0.37! Quite impressive, if you ask me. This chart clearly answers the main question of this analysis.

Can money buy happiness? Yes, it can. But the effects are mostly indirect.

At the very least, it’s clear that I tend to be happier when I spend more money on expense categories that have a big influence on my happiness.

What can I learn from this analysis?

Well, one thing’s certain: I should not go berserk and spend my money on anything imaginable. As I’ve discussed at the start of this article, I want to eventually become financially independent. This mindset is about focusing on getting the most value out of my money. In other words, I try not to voluntarily spend my money on things that don’t make me happy. I want my expenses to improve my happiness as much as possible.

So do I succeed in this mindset? Does my money actually buy me happiness? Yes, but I need to actually spend it on the best expense categories!

I should not feel bad for spending my money on holidays, instruments, running shoes, games, or dinners with my girlfriend. Hell no! These expenses make me a happier person.

All this data will obviously be different for any other person. Want to know how your personal financing influences your happiness? Just start tracking your happiness. I’d be very interested to see a similar analysis of someone else’s data!

Closing words

It will be interesting to revise this analysis after a couple of years, as my life continues to change. Maybe these results will drastically change once I fully grow up, become financially independent, get married, have kids, retire, become broke or a millionaire. Who knows? Your guess is as good as mine! 🙂

If you have any questions about anything, please let me know in the comments below, and I’ll be happy to answer!

Cheers!

What’s not included in Regular Daily Expenses, besides Holiday Expenses? Trying to distill specifically how you did the calculation.

Hi John! The Regular Daily Expenses contain a lot of expenses, like: rent, petrol, insurance, car maintenance, apartment & furniture stuff, clothing, stuff like that 🙂

Great article!

I would love to see an analysis of how the hedonic treadmill relates to your data. It looks to me like after each holiday spike, there is a very predictable trough. So while you may experience temporarily increased happiness during increased spending, you ultimately pay that happiness back 3-4 weeks later when you enter “withdrawal”. This would relate to a lot of the qualitative insight in Buddhism (and folk wisdom in general), would be really neat to see more quantitative data on the topic!

My hypothesis is that no positive experience really has a lasting effect on happiness, besides something like learning to meditate – after all, after all your spending, your happiness level ends up about where it started ;).

Best,

Scott

Thanks for the nice words, Scott! You raise a very interesting point. The hedonic treadmill is something that I do eventually want to write a happiness essay about. I do believe that happiness has a tidal motion, it inevitably goes up and down, which is unpreventable. I’d like to see how this tidal movement (troughs after spikes) and the “amplitude” is influenced by different factors, of which spending money is one!

Everlasting happiness is indeed non-existent. No matter how hard you try, there are going to be periods of unhappiness in your life. It’s the tidal motion that cannot be prevented. But I do believe that we can still influence the tide, even when that influence is small. And that’s why I track my happiness and believe that others can benefit from it as well. 🙂

How are you tracking your finances? It’s something I would like to get into, but have not found a good solution for yet.

I use YNAB! I manually enter every expense and income using their app, it’s really easy 🙂

In regards to measuring long term happiness vs short term happiness, I believe you can still use your short term data to support long term happiness. Developing a long life friendship is something we believe that will give us much more happiness than using a Playstation, but there’s no real “feeling” of long term happiness; we repeatedly enjoy the long term idea in short spurts that you’re already tracking. Seeing a friend, thinking about that friend, or reminiscing about your past with that friend produce positive feelings in the present that combine to give the feeling of such a thing contributing to your long term happiness. I think you’re definitely on the right track here with your choice of granularity.

Thanks, Tom. Those are good points. I can’t think of a way to differentiate between measuring long term vs short term happiness. Short term happiness can easily morph into long term happiness, like you say. 🙂

Let me leave another thought for you to consider: I think you might be measuring what I call “short-term happiness”. Maybe that’s not the best word for it. When you buy an X-box, it puts you in a happy mood for a few days or perhaps a bit longer. But, it doesn’t impact your long-term or permanent happiness about life. The same can be said for most purchases – you have a short term boost that doesn’t last. Your long-term happiness is mostly impacted by things that don’t require money, such as close relationships, being a valued part of a community, and your health. So when we talk about whether money can buy happiness, I think it depends on whether we’re talking about a temporary improvement in your mood or a more lasting outlook on life. Maybe I’m not doing a good job describing the difference. I’m also not sure how you would measure the latter, but maybe you can think of a way. Congrats on this work! – Jojo Bobo

Thanks Jojo, you raise some good points! The most difficult thing about happiness is that it’s impossible to measure objectively. I agree with you, long-term happiness comes from things that usually can’t be purchased (health, friends and relationships). However, I hope this article explains that spending money on certain things will have a bigger impact on your happiness than others. In the end, it depends on who you are and what influences your happiness the most. That’s why I try to spread the word about tracking happiness 🙂

Top notch reading here. Throughout the years I have been thinking about this question and changing my view over certain things. I currently weight every purchases that i make. If it doesn’t bring me happiness it just won’t happen. Expensive dinner out? Is it really worth a £80 meal for two? Don’t think so. People need to stop following the masses and start thinking for themselves.

P.S: Excellent data presentation!

Keep it up the good work!

Thank you Mr. WB. I’m sometimes surprised by how much people tend to spend their money only to follow the herd. At the end of the day, they are the ones living an unhappy life with luxury goods, paycheck to paycheck.

Try to spend money only on things that make you happy. That’s what every one should do.

Interesting data, I really quite like it and have often thought about trying something like this in my own life. I think taking score of how you feel and what you’ve done that day can give you an idea of what really makes you happy and what you don’t enjoy.

Thanks! Indeed, by tracking my happiness I’m able to determine what exactly makes me happy in life, and my goal is to find these things through unique analysis and articles like these 🙂

This is quite the rigorous analysis. I think money can buy you some happiness.

Based on the extent to which you measured the variables, I have a feeling numbers, graphs and statistics might make you even happier!

Best,

-PoF

Thanks, PoF!

I confess, I have a lot of fun visualizing all this data in ways that are rather new to the internet 🙂

Wow this is really impressive! It must have taken lots of time and hard work to put together this post. Thanks for the shout-out! 🙂

Glad you liked it 🙂

Well planned, well written, well executed. This is a keystone piece, I hope the whole world sees it.

Thanks for the kind words! 🙂